So, you want to boost your credit score and establish good credit. How do you do it?

Find out the simple rules that will help you boost your credit score is important for anyone interested in borrowing money for small or large purchases. This covers everything from buying clothes to financing a car or buying a house.

Credit scores are also important because employers look at these scores when you are being screened for a new job. Car insurance companies also look at these scores because they have found a connection between people with low credit scores and their driving records. This can also affect how much you pay for car insurance.

So how much can you save in interest payments when you can boost your credit score? A 2019 study found that on a $10,000 auto loan payable over five years, the difference in interest rates meant that those with better credit paid saved $31 monthly on average compared to people with bad credit.

What does credit agencies see?

Since building good credit is so important, it pays to know what credit bureaus are looking for when they compile a credit score.

First, they examine income and expenses and certain elements within a consumer’s credit profile, such as debt and repayment patterns. The rating agencies look at this since they want to know how much you pay and when you pay back loans every month.

In short, boosting your credit will help you save money and open more doors for the rest of your life. If you do not and have a low score, it will cost you thousands more in interest over your lifetime. In short, lenders want to see good credit scores because it establishes your creditworthiness as a borrower.

So how do you build a good credit score and keep it?

Here are nine suggestions to build positive credit:

Boost Credit Score the Easy Way

- Create A Reliable Payment History. Make the effort to pay on time, every time, and pay the bills when they are due. Don’t miss a payment. Moreover, rating agencies like it if you pay before the due date. If you can’t do this, paying the minimum is better than missing a payment.

Thanks to big data and automation, a missed payment, default, bounced check, a court conviction for any offense, being referred to a collection agency, or going bankrupt are among the worst things that will affect your credit report for years. In the case of most bankruptcies, this negative event will impact your credit history for seven years.

- Keep your total debt much lower than your available credit limit. Keep this debt-to-credit ratio as low as possible.

- Build a credit history, so lenders will see that you are an experienced borrower. Some banks allow you to open bank accounts (savings and checking) at age 16. If the bank sees that you can manage money by making deposits, you will build a relationship with a bank. This means you should start early, so you can have a long credit history as possible. There are a few suggestions to do this.

Establish your credit score as a student

If you are a student and at least 18 years old, have an adult (a parent, guardian, or adult friend) to allow you to become an authorized signatory on their credit card. This means you are both responsible for paying any debts you incur. The good news is that even if you don’t use the card often, the other person’s reliable and regular credit card payment will all be shared on your credit history. The key is to pay off the card debts on time and in full.

- All the credit you owe affects your score. This includes car payments, credit card payments, mortgages, student and installment loans.

- Keep your credit inquiries to a minimum and don’t apply for too much credit. This can suggest to the card company that you are desperate for new credit, so don’t accept those free credit card offers often made by clothing and department stores. Those free credit cards can work against you.

- If you are building a credit history from scratch, start with a checking account. If you have a good history with your existing bank or credit union, they may consider you a good credit risk and issue you a credit card. For new applicants, this card will often have a low limit, but that is a benefit. If you pay off debts and stay well below credit limits, banks will consider yourself a good credit risk. The industries most likely to offer your first credit card are gasoline companies, clothing stores, or store cards. These have a lower credit limit and focus younger people.

The secured credit card

- Another choice is to obtain a secured credit card. This is a card backed with a security deposit, or collateral, to test your creditworthiness. The lender can then use this collateral if you cannot pay the bill. Secured credit cards make the bank more willing to lend to you because they have your collateral in the form of a deposit. Secured cards are different from pre-paid cards. Prepaid cards may be convenient, but they do not affect your credit history. Discover and Capital One are good cards to investigate if you are interested in a secured card. After two or three years of having a secured card and cards with limited credit limits, you can apply for a card from a major credit card company with a higher, unsecured line of credit. Having a card from a major credit card issuer also helps raise your credit score.

- If you are just looking for ways to build a credit history, do not apply for too many new cards at once. As a college student or when you graduate, you will often be bombarded by new credit card offers. Do not take them up on the offer. The reason is that applying for too many cards at once sends a red flag to card companies that you are desperate. Don’t apply for a new credit card less than two months after you have received a new card. It’s better to throw those free credit card offers away. They may be flattering, but they can hurt your credit.

The personal loan way

- Another area to avoid is taking out a personal loan. Fueled by some aggressive fintech companies, the personal loan industry is expanding and they are enticing people to take a loan to consolidate debt or use it for additional spending. Beware of these proposals.

A 2020 article in Forbes found that in 2019, personal loan accounts grew 11% over 2018, according to an analysis by Experian. They found personal loans were being made at a faster rate than auto, mortgage, credit card, and student loans.

Like all loans, these have positive and negative sides. First, the rate and all associated fees have to be low enough to justify taking it in the first place. These loans are good if you want to pay down credit card debt, but the loan should be repaid on time, while credit card expenditures also decreased.

Understand the Basics of Credit

Two of the most important rules in building a credit card history are: Pay off the card in full and never carry a balance. This is because these two factors account for 35% of your credit score.

To get good credit, remember an important factor called the utilization rate. This is the rate you use from your available revolving credit. So, if you have a credit limit of $1,000, only use 10% to 20% of that ceiling credit limit or allow yourself to make $100 to $200 in monthly spending. The credit utilization rate accounts for 30% of your score.

Also, you have to use your card to buy something at least monthly. This shows the card company you still want the card, so buying something for as low as 1% of your revolving limit per month shows the card issuer you are an interested customer.

Your credit history is also based on the different types of loans you have received. Credit history companies want to see both installment loans (car, mortgage) and revolving credit (such as credit cards). This accounts for 10% of your total score.

FICO Scores

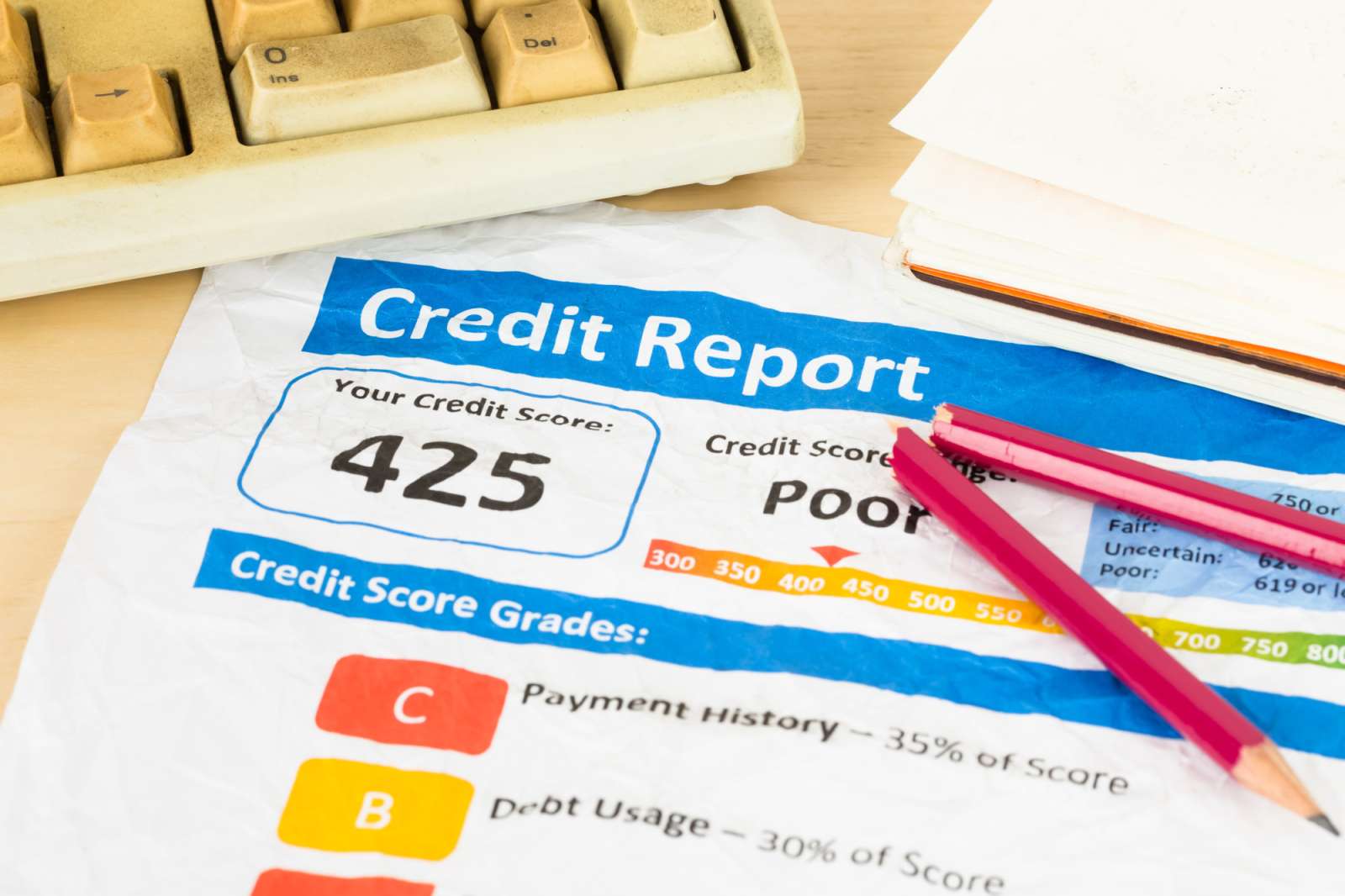

FICO credit scores range from 300 to 850. A credit score from 580 to 669 is considered fair; 670 to 739 is considered good; 740 to 799 is considered very good; and 800 and up are considered excellent, according to Equifax. A score over 670 will allow you to get favorable interest rates on many loans.

If you maintain a regular payment schedule, pay off balances in full, and follow the other suggestions in this article, it should take about nine to 12 months to get a credit score of 700 and beyond.

If you have good credit, you can often avoid paying a security deposit when you rent an apartment or start a new relationship with a phone or cable company. Over time, having a good credit score can save you thousands of dollars.

Other Benefits

Aside from financial ones, it pays to meet the demands of the rating companies so you can boost it a get a good credit score. That’s the benefit of having a good credit score. This can help build your self‐esteem, especially among young adults.

With higher self-esteem, combined with a good credit history and solid spending habits, people can enjoy more benefits in the modern consumer world.

–Chuck Epstein